Urban centers are emerging as new hubs for car title loans due to higher borrower concentrations and vehicle ownership. Metropolitan areas attract these short-term credits as urban dwellers face higher living costs and limited banking options. Lenders adapt with digital solutions and direct deposits, catering to the needs of digitally savvy urban borrowers seeking fast funding for emergencies or temporary gaps.

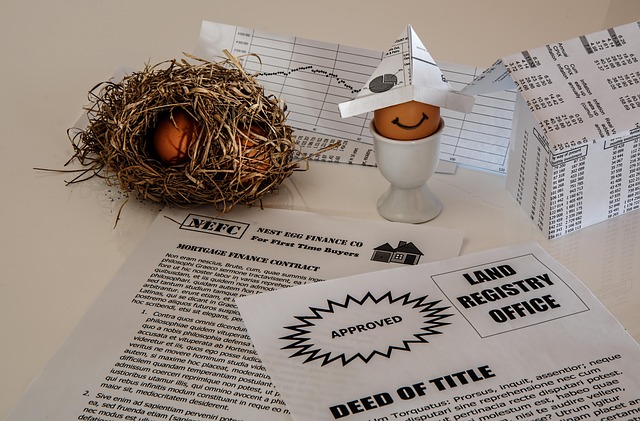

“Uncovering the urban landscape of car title loans, this article delves into the unique borrowing habits of city dwellers. With a focus on the ‘Car Title Loan Geographic Distribution’, we explore how these short-term loans are transforming financial access in metropolitan areas.

Through a demographic lens, we analyze the commonalities among urban borrowers, revealing insights into their motoring culture and economic realities. This comprehensive study sheds light on why car title loans have become a prominent alternative financing option for city residents.”

- Car Title Loans: Urban Borrower Trend

- Geographic Distribution of Title Loans

- Demographic Analysis: City Dwellers and Cars

Car Title Loans: Urban Borrower Trend

In recent years, the car title loan industry has witnessed a notable trend in urban borrowing. These loans, secured by an individual’s vehicle title, have traditionally been associated with borrowers in suburban and rural areas due to their need for quick cash access and often less stringent credit requirements. However, data reveals that urban centers are seeing a rise in car title loan applications. This shift can be attributed to various factors such as higher living costs, limited financial options for those without stable employment, and the appeal of easy, short-term funding.

The geographic distribution of car title loans is evolving, with cities becoming hotspots for these types of transactions. Urban borrowers often find themselves in situations where they need fast cash for unforeseen expenses or to bridge temporary financial gaps. While interest rates and vehicle collateral remain key aspects of these loans, direct deposit options are gaining popularity among urban lenders, catering to the needs of a digitally savvy demographic.

Geographic Distribution of Title Loans

The geographic distribution of car title loans reveals a clear urban bias. These short-term, high-interest credit products are more prevalent in metropolitan areas, reflecting the higher concentration of potential borrowers with access to vehicles and proof of income. Urban centers, with their bustling economies and diverse populations, often serve as hotbeds for title loan services due to the ready availability of collateral—motor vehicles—and a larger pool of individuals seeking emergency funds.

Compared to rural or suburban regions, urban areas typically have higher costs of living, including housing and transportation expenses. This can push residents towards alternative financing options, such as car title loans, when facing unexpected financial strains. The accessibility of these loans, often with less stringent requirements compared to traditional banking options, makes them an attractive solution for those in need of fast cash. However, it’s important to note that this convenience comes at a cost through higher interest rates and potential risks associated with defaulting on such secured loans.

Demographic Analysis: City Dwellers and Cars

In the context of car title loans, demographic analysis reveals a notable trend among borrowers – they are predominantly urban dwellers. This geographic distribution suggests that city residents often turn to these short-term financial solutions for emergency funding. With limited access to traditional banking services and tighter financial regulations in metropolitan areas, car title loans present an attractive option for those seeking quick cash. The appeal lies in the flexible loan terms and customizable payment plans, catering to the diverse financial needs of urban populations.

The car title loan market is not just about providing emergency funding; it also caters to borrowers who require more adaptable financing options. Urban dwellers, with their dynamic lifestyles and varying income streams, appreciate the flexibility offered by these loans. Unlike complex and lengthy processes associated with conventional loans, car title loans offer a straightforward approach, allowing city residents to access funds swiftly for unexpected expenses or urgent needs.

In conclusion, the demographic analysis of car title loan borrowers reveals a clear urban concentration. The geographic distribution data highlights that cities are hotspots for these loans, with city dwellers possessing cars in higher numbers and demonstrating a greater need for short-term financial solutions. Understanding this urban borrower trend is essential for lenders to cater to the unique financial landscapes of metropolitan areas, ensuring responsible lending practices in the car title loan sector.