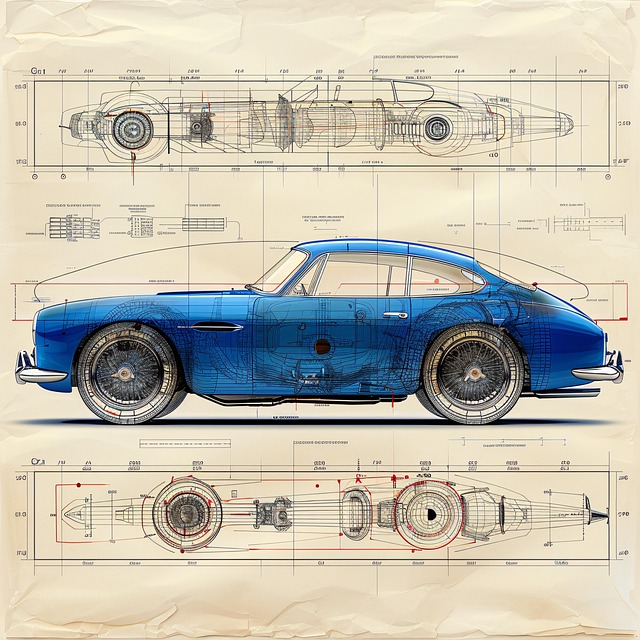

Car title loans exhibit uneven geographic distribution, concentrating in urban and suburban areas with robust economies. Online applications drive their widespread adoption. Regulatory scrutiny is intense in urban centers like Fort Worth due to potential debt cycles and high-risk customer groups lacking financial literacy. Efforts are underway to implement stricter guidelines, focusing on improved transparency and flexible payment plans, to mitigate risks associated with these loans secured by vehicle titles, catering to emergency funding needs while balancing consumer protection.

“Title loans, a form of secured lending backed by vehicle ownership, have sparked regulatory interest due to their demographic appeal and geographic concentration. This article delves into the ‘Car Title Loan Geographic Distribution’ phenomenon, analyzing hotspots where these loans are prevalent. We explore how regulatory bodies target high-risk customer groups and discuss policy implications to mitigate vulnerabilities in title loan markets. By understanding the geographical and demographic dynamics, policymakers can craft effective strategies to protect borrowers.”

- Uncovering Car Title Loan Hotspots: Geographic Distribution Analysis

- Regulatory Scrutiny: Targeting High-Risk Customer Groups

- Policy Implications: Addressing Vulnerabilities in Title Loan Markets

Uncovering Car Title Loan Hotspots: Geographic Distribution Analysis

In the landscape of alternative financing, car title loans have emerged as a significant segment, drawing regulatory attention due to their unique customer demographics and repayment patterns. Uncovering the geographic distribution of car title loan hotspots is a crucial step in understanding this growing industry. By analyzing data on loan origination and payoff locations, researchers can identify areas where these loans are most prevalent and sought after. This geographical analysis reveals urban centers and suburban regions with higher concentrations of car title lending activities.

The mapping of car title loan geographic distribution showcases hotspots in metropolitan areas known for their bustling economies and diverse populations. These locales often cater to a wide range of borrowers, from working professionals seeking quick cash to individuals facing unexpected financial emergencies. Online applications play a pivotal role in this phenomenon, as they facilitate accessibility and convenience for both lenders and borrowers, contributing to the widespread adoption of car title loans across various regions.

Regulatory Scrutiny: Targeting High-Risk Customer Groups

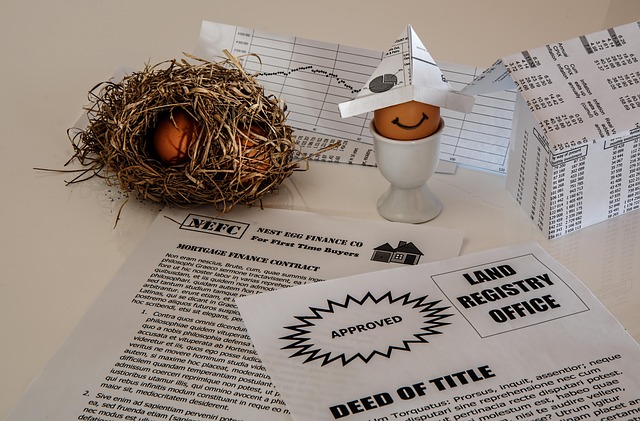

Regulatory scrutiny has increasingly focused on car title loan services, particularly those targeting high-risk customer groups. This attention is driven by the uneven geographic distribution of these loans and their potential to trap borrowers in cycles of debt. In many regions, especially urban areas like Fort Worth, loans secured against vehicle titles have proliferated, offering quick cash but often with usurious interest rates and harsh repayment terms.

Regulatory bodies are concerned about the impact on vulnerable populations, who may lack the financial literacy or resources to manage these loans effectively. As a result, efforts are being made to implement stricter guidelines, including enhanced transparency in loan approval processes and flexible payment plans that mitigate the risks associated with this type of lending, specifically targeting areas known for high car title loan activity.

Policy Implications: Addressing Vulnerabilities in Title Loan Markets

The car title loan market, with its promise of quick and accessible funding, often presents unique policy challenges due to its geographic distribution and target customer demographics. These loans, secured by a consumer’s vehicle title, cater to individuals seeking emergency or same-day funding, highlighting a need for regulatory interventions that balance accessibility with consumer protection. The uneven geographic distribution of title loan providers can create vulnerabilities, particularly in areas with limited financial services options.

Regulatory bodies must consider the impact of these loans on vulnerable populations, ensuring fair practices and transparent terms. This includes addressing issues related to vehicle valuation, interest rates, and repayment terms. By implementing robust regulations, especially in regions where such loans are prevalent, policymakers can help mitigate potential harm while allowing legitimate financial services to thrive, fostering a more inclusive and stable economic environment.

The analysis of car title loan geographic distribution highlights concentrated hotspots, indicating a need for targeted regulatory interventions. By scrutinizing high-risk customer groups, policymakers can develop strategies to address vulnerabilities in these markets, ensuring fair lending practices and consumer protection without stifling legitimate access to credit. Understanding the demographics and location of car title loan activity is a critical step towards creating a more robust and equitable financial landscape.